Getting started with ScaleXP is fast and straightforward — most finance teams are up and running in just a few days and using ScaleXP for month end in about 2 weeks

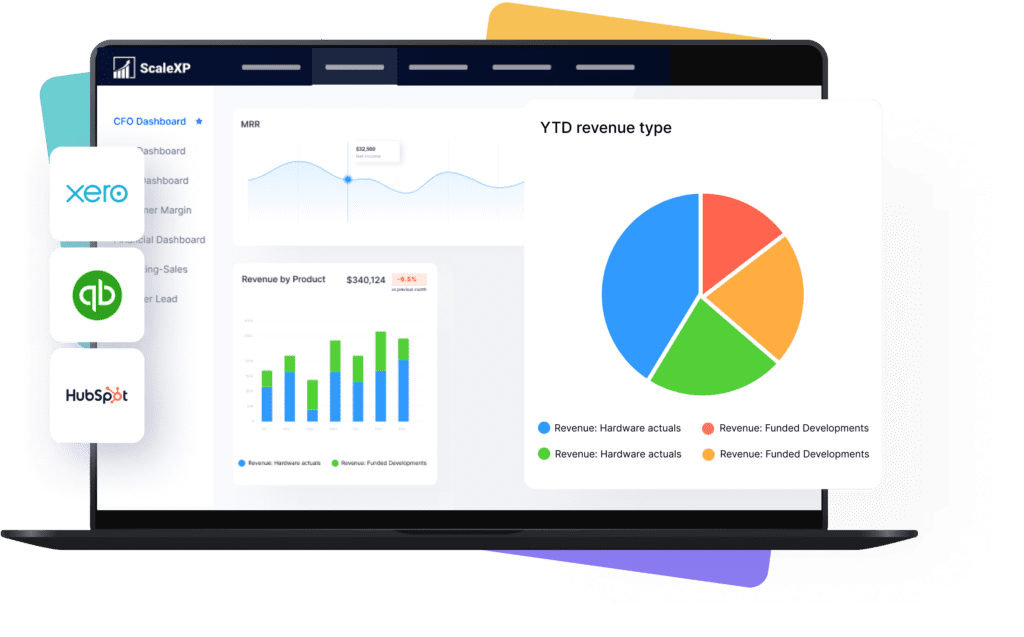

Connect your systems: Simply link ScaleXP to your accounting software (Xero, QuickBooks) and, if needed, your billing or CRM system such as Stripe or Salesforce.

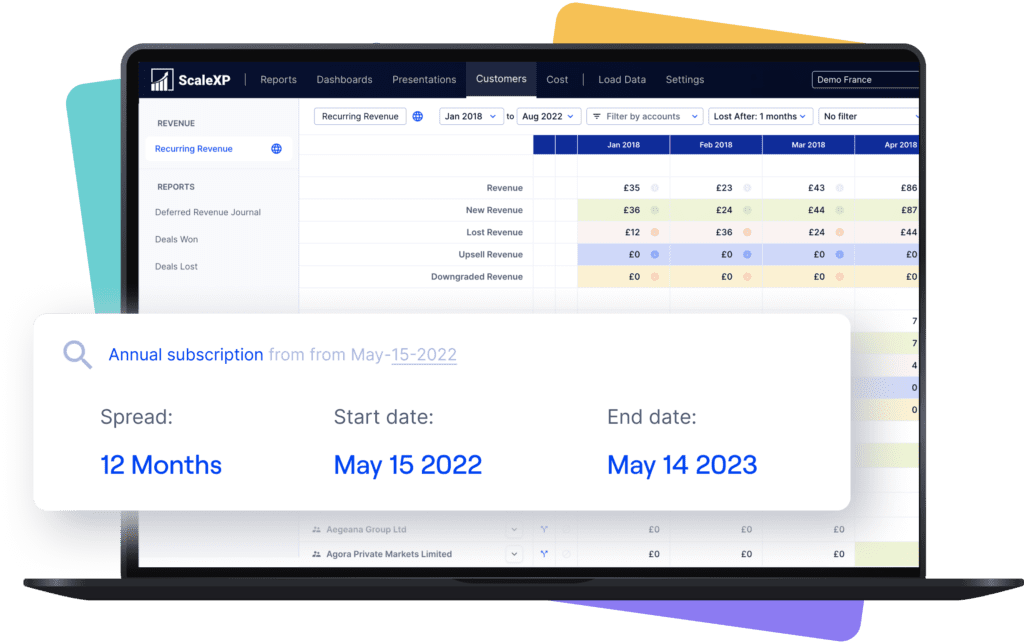

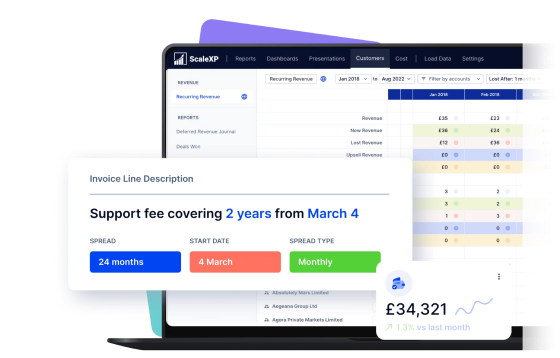

Sync and review data: ScaleXP automatically imports your invoices, bills, and journals, identifying key transactions for accruals, deferrals, and revenue recognition.

Set up automation rules: Define how you want accruals, prepayments, and revenue schedules handled — our Customer Success team will help you configure these in line with your accounting policies. And we always suggest booking a short 30 minute meeting with them to ensure the system is optimized to your requirements.

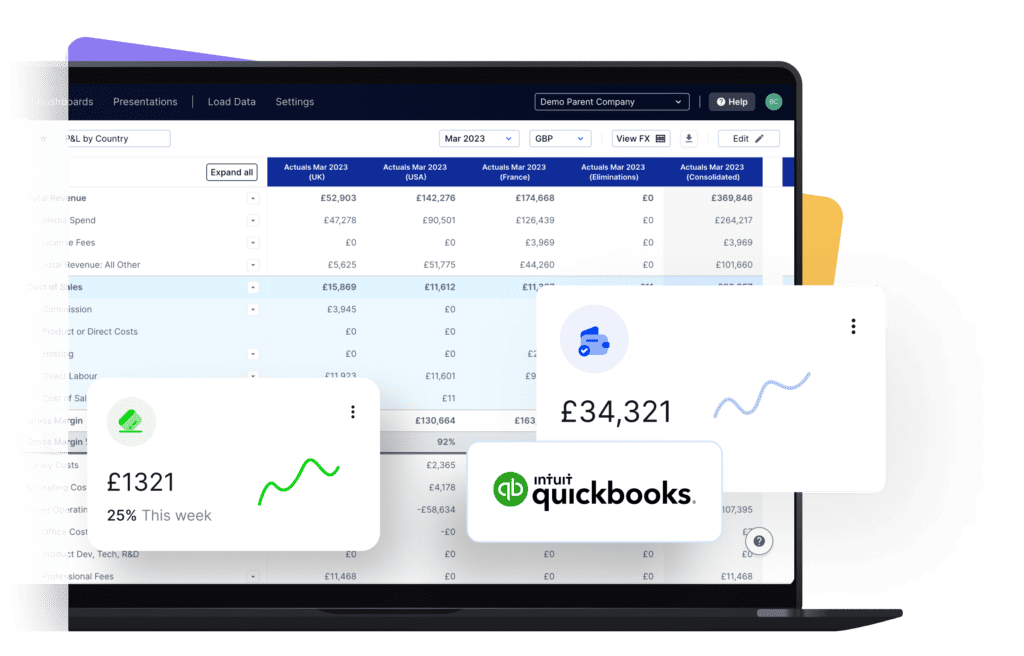

Generate and validate journals: Within minutes, ScaleXP prepares automated journals and reconciliations that you can review, approve, and post directly back to your accounting system.

Every step is fully guided, transparent, and supported by our 5★-rated onboarding team, so you stay in control while gaining the speed and accuracy of full automation.